BBH Expands Connectors Program by Adding Tourmaline Partners for Outsourced Trading Solutions

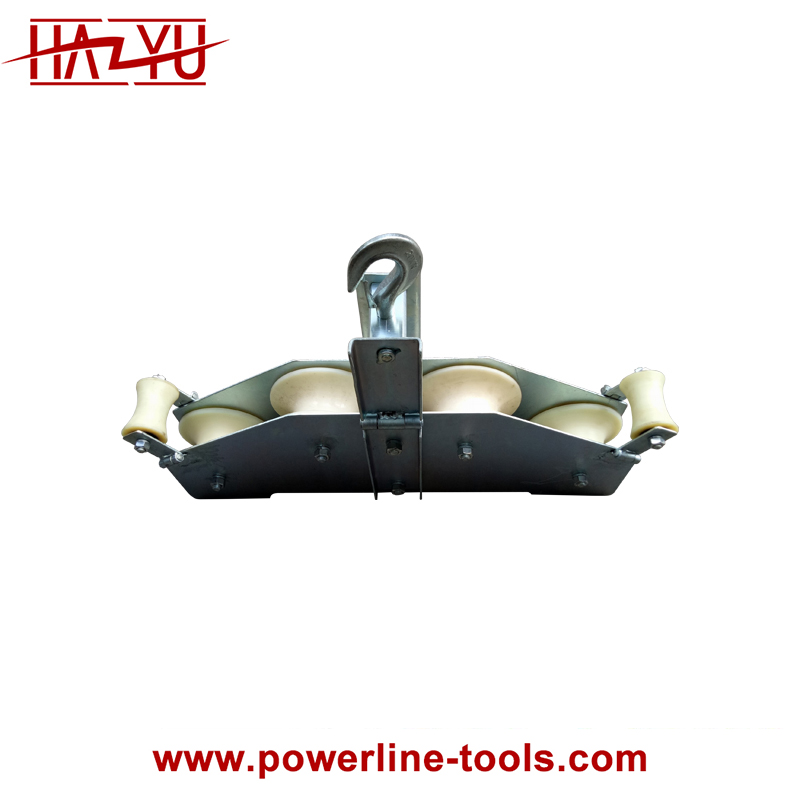

Tourmaline Partners provides its clients with flexible, front office trading solutions to meet demand for outsourced trading, expected to grow 45% in 2023[http://][1], Suspension ladder

Boston, Massachusetts, October 2, 2023– Brown Brothers Harriman & Co. (BBH) today announced that Tourmaline Partners’ execution services are available to provide BBH clients with flexible front office trading solutions in global equities, derivatives, and ETFs. Tourmaline’s tailor-made trading solutions complement BBH’s robust foreign exchange and investment operations solutions and provide clients with choice and flexibility in their operating model. This expands BBH’s Connectors program, a cohort of specialist third-party fintech and service providers that can help drive outcomes for BBH clients.

“This announcement is great news for the industry. BBH and Tourmaline are two first-class organisations that have been our partners for a long time. Through their respective solutions we are able to augment our internal capabilities with stellar external expertise and build our best-of-breed operating model,” said Evan Fire, COO of Pzena Investment Management. “With Tourmaline we have enhanced our trading effectiveness and increased operational resiliency. Our use of BBH for trade messaging and FX trading helped increase STP resulting in a dramatic increase in efficiency and improved execution quality.”

Market demand for outsourced trading is growing among larger investment managers as they seek to expand their reach, enhance trading performance and efficiency, and better manage costs. According to a report by Opimas[http://][1], outsourced trading is expected to grow 45% to $1.7 billion in revenue in 2023, as larger asset managers seek to “outsource part of their trading activity and right-size their trading desks.”

Through Tourmaline’s inclusion as a BBH Connector, asset managers can combine their usage of Tourmaline’s trading solutions with BBH’s technology, data services, and FX trading solutions, helping to create their optimal operating model. Key benefits include:

“Clients preparing their operating models for the future are more often demanding front office trading solutions,” said Chris Gothard, Partner for Markets at BBH. “We are pleased to welcome Tourmaline’s experienced team into the BBH Connectors program. Tourmaline provides clients with trading capability across global equities, derivatives, and ETFs and flexible whole or partial outsourcing that best support their existing operating models.”

“In the past decade we have seen managers of all sizes, from emerging hedge funds to asset owners with AUM up to $1T+, supplement their in-house capabilities with trading solutions to expand their reach to global liquidity and market intelligence,” said Aaron Hantman, CEO of Tourmaline Partners. “We are excited to be part of the BBH Connectors Program as BBH’s history and expertise in FX trading and technology complements our areas of expertise. Tourmaline can offer unique trading solutions for both supplemental trading and those clients looking for full- service solutions.”

[1] Opimas – Report: Outsourced Trading – Poised for Strong Growth in 2023

* This update is intended only for distribution in the United States and United Kingdom.

BBH Connectors complement BBH’s modular, provider-agnostic technology solutions and BBH Infomediary® data services to optimise asset manager and financial institutions operating models. The Connectors program is a critical part of how BBH works with its clients seeking an integrated suite of flexible, provider-agnostic capabilities, that drive efficiencies, preserve choice, and create a future-ready operating model that will flex as clients’ strategies demand.

Connectors launched in June 2021 with the inaugural cohort of four third-party technology and business solution providers that bring expertise in ESG data, insurance accounting, class action recovery services, and AI, while also showcasing several BBH-built solutions which can be provided together or separate from our custody and administration services

More detailed information on our Connectors Program can be found at: https://www.bbh.com/us/en/what-we-do/investor-services/bbh-connectors.html

About Brown Brothers Harriman

BBH is a privately held financial institution that has been a thought leader and solutions provider for over 200 years. The firm serves individuals, families, businesses and institutions in its three business lines: Private Banking, Investment Management, and Investor Services. BBH’s culture of accountability fosters deep and lasting relationships built on commitment, adaptability, and trust. The company is independent, selective, and specialised by design.

BBH’s Investor Services business provides cross-border custody, accounting, administration, execution, and technology services to many of the world’s leading asset managers and financial institutions.

BBH operates its global business out of seventeen offices located in New York, Boston, Beijing, Charlotte, Chicago, Dublin, Grand Cayman, Hong Kong, Jersey City, Kraków, London, Luxembourg, Nashville, Philadelphia, Tokyo, Wilmington and Zürich. For more information, please visit www.bbh.com.

Tourmaline Partners is a leading outsourced trading solutions firm[2], providing tailor-made services to hedge funds and asset managers of all sizes, pairing clients’ trading needs with experience and expertise. Founded in 2011, Tourmaline services more than 350 institutional clients trading in more than fifty global markets. Through continuous investment in state-of-the-art technology and human capital, a singular focus on trading, and non-competitive relationships with 400+ global brokers, Tourmaline provides clients with access to liquidity, market intelligence and customised workflows for defining, measuring, and achieving execution quality. Headquartered in Stamford, Connecticut, with offices in London and Sydney, Tourmaline employs more than 35 highly experienced traders and provides full trade support in clearing, settlement, and TCA reporting, as well as comprehensive research funding via CCAs, CSAs, attribution, and aggregation.

Terminal Tackle [2] Source: Chartis Research 2021 Market and Vendor Landscape Analysis